First-Time Buyer Common Mistakes

Avoid the pitfalls that cost other first-time buyers thousands. These aren't hypothetical warnings. These are real mistakes that real buyers made. Each one costs money, time, or peace of mind. Learn from their experience.

Financial Mistakes

Not Getting Pre-Approved Before House Hunting

Seeing homes outside your budget creates disappointment and wastes time. Sellers don't take unqualified buyers seriously. Pre-approval first, shopping second.

Maxing Out Pre-Approval Amount

Just because a lender approves $400K doesn't mean you should spend $400K. Lenders don't know your other financial goals, lifestyle expenses, or risk tolerance.

Forgetting About Closing Costs

Saving for down payment but forgetting closing costs (2–5% of purchase) leaves buyers scrambling. Some can't close on time. Some drain emergency funds.

Making Large Purchases Before Closing

Buying furniture, cars, or appliances before closing changes the debt-to-income ratio. Lenders recheck credit. New debt can kill loan approval days before closing.

Changing Jobs During the Process

New employment raises red flags for underwriters. Even lateral moves require new verification. Self-employment makes it worse. In many cases, deals fall apart over job changes.

Search & Offer Mistakes

Falling in Love With the First House

First home tours create artificial attachment. Buyers lose negotiating power and objectivity. Often overpay or ignore red flags.

Skipping Neighborhoods You Haven't Heard Of

Buyers stick to familiar areas and miss better value. Lesser-known neighborhoods often offer more space, better schools, and stronger appreciation potential.

Buying Based on Emotion Instead of Numbers

"It just feels right" doesn't justify overpaying. Emotions fade. Mortgages don't. Falling in love clouds judgment about condition, price, and fit.

Waiving Inspection to Win Offer

Skipping inspection to be competitive means buying unknown problems. Structural issues, electrical hazards, and plumbing failures hide until they’re your problem.

Not Researching the Seller's Situation

Motivated sellers accept lower offers. Unmotivated sellers wait for full price. Knowing the seller's timeline creates leverage.

Due Diligence Mistakes

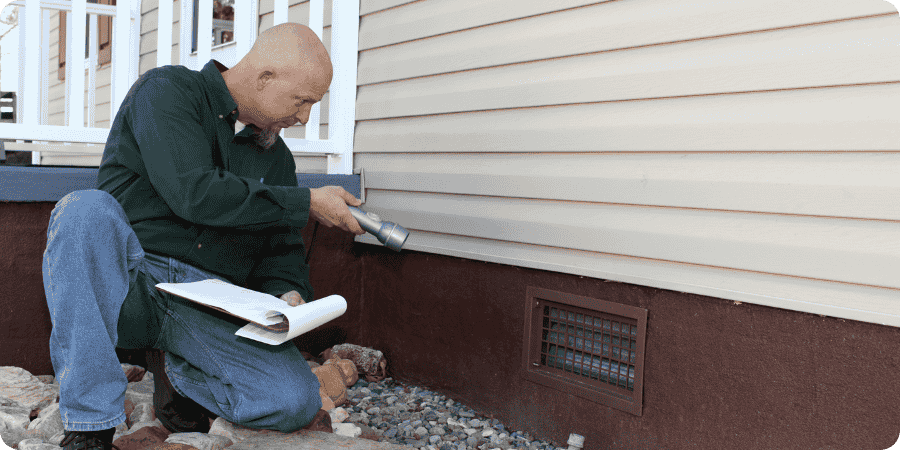

Not Attending the Home Inspection

Skipping inspection means relying on written reports without context. Inspectors explain severity and urgency in person.

Ignoring HOA Rules and Financials

HOA restrictions limit what you can do. Weak finances can lead to special assessments. Monthly fees often rise over time.

Skipping the Final Walk-Through

Assuming everything is fine leads to closing-day surprises. Repairs may be incomplete. Fixtures may be removed.

Not Researching Future Development

Empty lots can become apartments. Quiet roads become highways. Development plans change value and quality of life.

Closing Mistakes

Not Reading Closing Disclosure Carefully

Unexpected fees and changed terms hide in closing documents. Problems discovered after closing are harder to fix.

Wiring Funds Without Verification

Wire fraud targets home buyers. Scammers impersonate title companies and provide fake instructions. Stolen funds are rarely recovered.

Not Having Home Insurance Set Up

Lenders require proof before closing. Last-minute shopping means higher rates and limited options. Closings can be delayed.

Post-Purchase Mistakes

Immediately Starting Renovations

Draining savings for renovations eliminates emergency funds. Living in construction increases stress. Needs become clearer over time.

Ignoring Regular Maintenance

Deferred maintenance leads to expensive emergencies. Small problems become big problems. Home value suffers.

Not Building Emergency Fund Back Up

Using emergency funds for purchase costs leaves no cushion. The first year brings surprise expenses.

Real Estate Glossary of Terms

Stop nodding along when you don't understand. Know exactly what every term means. Real estate has its own language. Understanding it prevents costly mistakes and builds confidence at every step. Keep our glossary handy during your homebuying process.

Download the Glossary PDFFrequently Asked Questions

The answers you're actually looking for, without the industry jargon or runaround.You're not alone in wondering these things. Every first-time buyer has the same questions about down payments, timing, what's actually negotiable, and whether they're truly ready. We've gathered the most common concerns and answered them straight. No fluff, no sales pitch, just the information you need to move forward with clarity.

Rent if you’re uncertain about the location, don’t have steady income, can't afford maintenance surprises, not ready for commitment. Both are valid choices.

Pest inspection: recommended in all climates.

Radon test: recommended in high-risk areas.

Sewer scope: recommended for homes over 20 years old. Small costs prevent huge surprises.

Test Your Homebuying Knowledge

Most first-time buyers get at least half of these wrong. See where you stand before you start shopping.This quiz reveals gaps in your homebuying knowledge before they cost you money. No email required. No sales pitch after. Just an honest assessment of what you know and what you need to learn.

Down payment is only part of the picture. Closing costs add 2-5% of purchase price. Moving expenses run $1,000-5,000. You still need a three to six months emergency fund after buying. Total upfront needs typically hit 15-20% of purchase price. Buyers who save only for down payment scramble at closing or drain savings completely.

Pre-approval comes before house hunting starts. Looking at homes outside your budget wastes everyone's time and creates disappointment. Sellers and their agents ignore buyers without pre-approval. Know your real budget first, shop second. This prevents falling in love with unaffordable properties.

Lenders approve based on debt ratios, not your other goals, lifestyle costs, or risk tolerance. The 28% rule keeps housing affordable while leaving room for other expenses, savings, and life changes. Just because a bank lends you money doesn't mean you should borrow it all. Build a cushion for real life.

Attending the full inspection lets you ask questions, understand severity versus cosmetics, and learn about your future home's systems. Written reports often look scarier than reality or miss context the inspector provides verbally.

First homes create false attachment and eliminate objectivity. Viewing multiple properties builds perspective about value, conditions, and trade-offs.

Low appraisal gives you options. Sellers can reduce price. You can cover the gap. Or you can cancel if protected by an appraisal contingency.

Lenders recheck credit before closing. New debt changes ratios and can kill approval. Buy everything after you own the house.

Weak reserves mean future special assessments. Rules restrict property use. Minutes reveal conflicts and upcoming projects. Research thoroughly.

Compare every line to your Loan Estimate. Question changes. Catching errors before closing is easy—fixing them after signing is hard.

First-year homeownership brings surprise expenses. Rebuild emergency fund before upgrades. Stability beats aesthetics.

Homebuying has dozens of decision points where knowledge prevents costly errors. The buyers who succeed are rarely the ones who knew everything from the start. They're the ones who identified gaps early and filled them before making offers.

The questions you missed point to areas worth studying further. Scroll back through the mistakes section and focus on those topics. Save the glossary for reference. And when you're ready, find an agent who expects you to ask questions instead of just nodding along.

Working With

Clear answers to how PrimeStreet helps you find the right agent without guesswork.

How does PrimeStreet agent matching work?

You provide details about price range, preferred areas, timeline, and priorities. PrimeStreet’s algorithm matches you with agents who specialize in exactly those parameters and have proven success with similar buyers.

Is there a cost to use PrimeStreet?

No. PrimeStreet’s agent matching service is completely free for home buyers and sellers. There are no hidden fees, obligations, or pressure.

What if I don’t like the matched agent?

It’s uncommon due to thorough matching criteria, but if the fit isn’t right, PrimeStreet provides alternative matches. You’re never stuck with a poor fit.

Can I still use PrimeStreet if I already have an agent?

PrimeStreet works best before selecting an agent. If you’re under an exclusive agreement, honor it. If you’re exploring options and not satisfied, PrimeStreet can help before you commit.

First-time home buying has enough stress without repeating others’ costly errors.

We see this every day with real buyers who come to us unsure where to start or worried about making the wrong decision too early.

Our goal is to help you avoid surprises, expensive lessons, and regrets. PrimeStreet agents are matched to your specific situation and work to help you avoid common traps.