Tips for New Homeowners (2024)

Published on April 24, 2024 | 4 Minute read

Melanie

Ortiz Reyes

Content Specialist

Becoming a new homeowner is an exciting milestone in life, marking a significant step towards independence and stability. However, owning a home also comes with its share of responsibilities and challenges. From maintenance tasks to financial considerations, there’s a lot to learn and manage. To help you navigate this new chapter smoothly, here are some essential tips for new homeowners.

1. Understand Your Finances

Before diving into homeownership, it’s crucial to have a clear understanding of your financial situation. Calculate all costs associated with buying and owning a home, including mortgage payments, property taxes, insurance, utilities, and maintenance expenses. Create a budget that accounts for these costs along with your other financial obligations.

2. Build an Emergency Fund

Unexpected expenses can arise when you least expect them, such as a leaking roof or a broken appliance. Having an emergency fund specifically earmarked for home-related repairs and maintenance can provide peace of mind and prevent financial stress during emergencies.

3. Invest in Home Insurance

Protect your investment by obtaining comprehensive home insurance coverage. This insurance can safeguard your home and belongings against damages caused by natural disasters, theft, or accidents. Review your policy annually to ensure it adequately covers your needs.

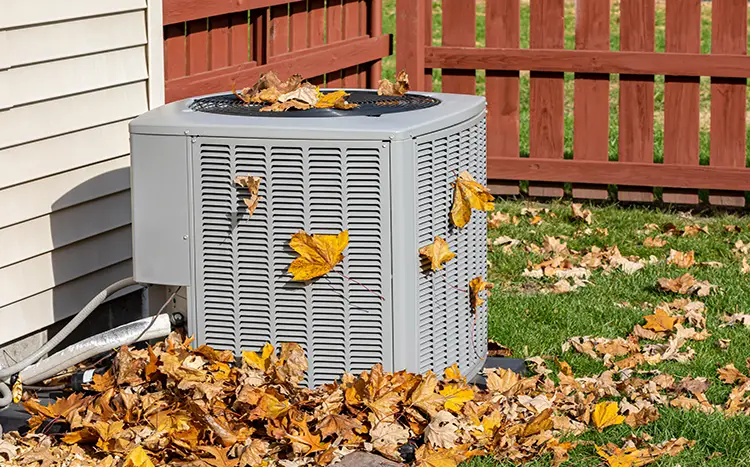

4. Perform Regular Maintenance

Preventive maintenance is key to preserving the value and functionality of your home. Create a maintenance schedule for tasks such as HVAC system checks, gutter cleaning, lawn care, and plumbing inspections. Addressing issues promptly can save you from costly repairs down the road.

5. Familiarize Yourself with Home Systems

Take the time to learn about essential home systems such as plumbing, electrical, heating, and cooling. Know how to shut off water and gas valves in case of emergencies. Understanding these systems can help you troubleshoot minor issues and communicate with professional technicians when needed.

6. Prioritize Safety Measures

Make sure your home is equipped with smoke detectors, carbon monoxide detectors, and fire extinguishers in appropriate locations. Develop a fire escape plan with your family and practice it regularly. Invest in sturdy locks and consider installing a home security system for added protection.

7. Save Energy and Reduce Costs

Implement energy-efficient practices to lower utility bills and reduce your environmental footprint. Use programmable thermostats, LED light bulbs, energy-efficient appliances, and adequate insulation. Consider conducting a home energy audit to identify areas for improvement.

8. Get to Know Your Neighborhood

Building a sense of community can enhance your homeownership experience. Introduce yourself to neighbors, participate in local events, and join community groups or associations. Knowing your neighborhood well can also help you stay informed about developments that may impact your property.

9. Keep Records Organized

Maintain a file with important documents related to your home, such as mortgage papers, insurance policies, warranties, and receipts for home improvements. Having organized records makes it easier to track expenses, make insurance claims, and provide documentation when selling your home in the future.

10. Plan for Future Upgrades

As you settle into your new home, consider future upgrades or renovations that align with your lifestyle and long-term goals. Prioritize projects based on functionality, energy efficiency, and potential return on investment. Research contractors or DIY resources for reliable and cost-effective improvements.

Becoming a new homeowner is a rewarding journey filled with opportunities to create a comfortable and secure living environment. By understanding your finances, investing in maintenance and safety measures, and staying proactive in managing your home, you can navigate this experience with confidence. Remember, every step you take to care for your home adds value and contributes to your overall satisfaction as a homeowner.